CIBI President and CEO Pia Arellano breaks down credit, money management, and what it really takes to build a strong financial future.

When money talk starts to feel intimidating, we suggest calling someone knowledgeable in the matter and capable of explaining it without the jargon. In this edition of LA Phones A Friend, we’re dialing up Pia Arellano, President and CEO of CIBI Information Inc., the country’s first and longest-standing credit bureau, to break down the often misunderstood world of finance, credit, and why your financial footprint matters more than you think.

With over 30 years of experience in data and finance, Pia has dedicated her career to expanding fair access to credit and helping Filipinos build confidence in their financial decisions. A cum laude graduate of BS Economics from the University of the Philippines, she began her career in product management at a leading multinational bank before later serving as President and CEO in a global credit information company. Today, at CIBI, she steers the organization’s strategy and operations with a clear focus on inclusion and trust.

Founded in 1982 under the Central Bank of the Philippines, CIBI has shaped how trust is built in banking, lending, and beyond. Under Pia’s leadership, it has evolved into something far more human: a kind of financial “big brother” that turns data into opportunity and reputation into access. In this candid conversation, Pia unpacks why credit history matters to everyday Filipinos, how fair access to financial tools can become a powerful act of nation-building, and the first steps into securing a good financial future.

READ ALSO: LA Phones A Friend: How Do I Start Investing?

Why is understanding one’s credit history so essential today?

Pia: Your credit history is your financial identity, or your reputation in data form. It is how you prove that you are responsible and trustworthy to the world. Well-managed credit is the essential first step toward life-changing goals such as owning a home or a car. A strong credit history also gives you the power to bargain for better rates and higher limits, because lenders see you as a low-risk partner.

From your perspective, what recent shifts in the financial landscape should young professionals be paying attention to?

Pia: One of the most important shifts young professionals should understand is that financial inclusion today is no longer driven by charity or access alone. It is driven by trusted data and responsible financial behavior.

In the past, many were excluded from the formal financial system because they had no records. Today, inclusion happens when individuals build a credible financial identity, and that starts with how they manage credit, debt, and savings.

Creditworthiness is becoming a financial passport. Credit is no longer just about loans; it is becoming part of your financial identity. Lenders, employers, landlords, and telecommunications companies are increasingly relying on credit data and behavioral signals. Digital footprints, such as payment consistency and timeliness, matter as much as income, which is why paying on time, every time, is non-negotiable. Popular offers like Buy Now Pay Later can either help build or damage your profile. Credit is an asset you build, not just a tool you use.

The shift from collateral-based lending to data-driven risk assessment is transforming finance. With good-quality, accurate, and ethical data, lenders can assess risk more precisely, good borrowers are rewarded, and irresponsible borrowing is discouraged. Trusted data creates a virtuous cycle, where responsible behavior translates into better data, greater access, and better outcomes.

Data, identity, and opportunity are now interconnected. In a digital economy, your financial behavior becomes part of your economic identity. Trusted financial data supports entrepreneurship and SME growth, enables job creation, and expands access to housing, education, and healthcare. For young professionals, this means that every financial decision, big or small, contributes to a long-term data trail that either opens doors or quietly closes them.

Many young people are eager to build wealth but unsure where to begin. In your view, what’s the most fundamental financial habit they should master early?

Pia: Financial freedom starts with financial responsibility, and creditworthiness is its foundation. There are three habits to master early. First, pay on time, every time. Second, save before you spend. Third, borrow with intention.

Digital finance makes it easier to borrow, but it also makes it easier to mess up. Small digital loans add up, so do not treat approved credit as free money. If it does not fit your monthly cash flow, it is not affordable.

What common misconceptions about credit or financial responsibility would you like to correct for Gen Z and young leaders?

Pia: Debt is a tool, not a trap. Many young people view loans as negative, but debt can be a tool for growth when managed with discipline. Being part of a credit bureau is also not about being watched; it is about being seen, so that lenders can help you manage your debt before it becomes a burden.

If you could give one piece of long-term financial wisdom to the next generation of tastemakers and decision-makers, what would it be?

Pia: Protect your reputation above all. In a data-driven world, your financial integrity is your most valuable asset.

Looking ahead, what kind of financial mindset do you hope your own children—and young Filipinos in general—carry into the future?

Pia: I hope young Filipinos carry a mindset rooted in financial responsibility, long-term thinking, and pride in being financially trustworthy. First, I hope they see money not just as something to spend, but as something to steward. In a world of easy credit and digital wallets, discipline matters more than ever.

Second, I hope they embrace the idea that their financial behavior today shapes their opportunities tomorrow. Whether they realize it or not, they are building a financial identity. A good credit history opens doors to employment, housing, and entrepreneurship, while a poor one can quietly close the same doors. Being intentional early on makes a lifetime of difference.

Third, I hope they adopt a growth mindset toward money. This means continuously learning about savings, investments, risk, and insurance, and not being intimidated by financial systems. Financial literacy is not about being rich–it is about being resilient.

Finally, I hope young Filipinos connect their personal financial choices to a bigger purpose. When individuals are financially responsible, communities become more stable, businesses can grow more sustainably, and our country becomes more inclusive. Good financial habits are not just personal wins—they are acts of nation-building.

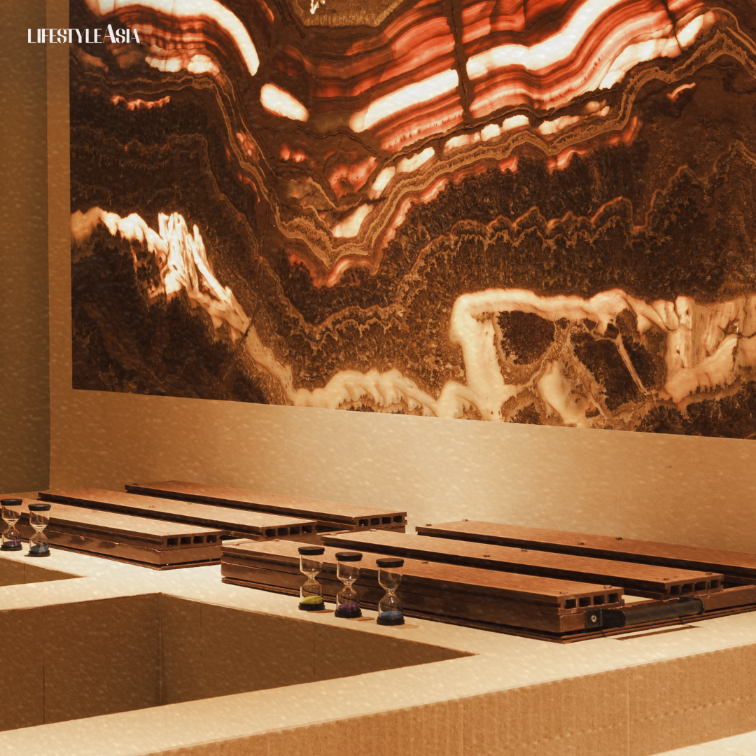

Photography by Sela Gonazales