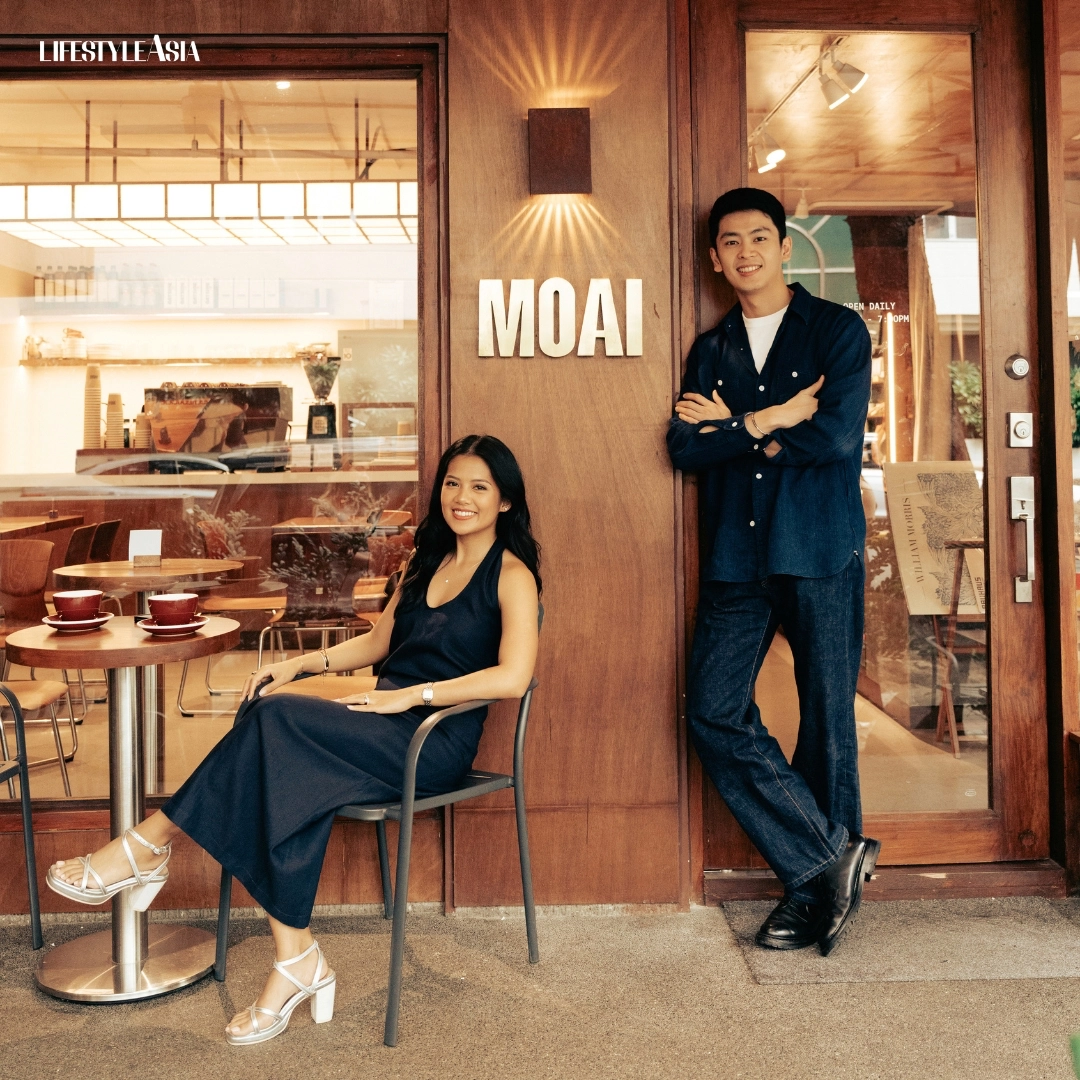

In an industry still largely dominated by men, the women of Kaya Founders are making their mark—and reshaping the narrative of what leadership in tech and venture capital can look like.

From launching local chapters of global networks to mentoring the next generation of founders, Danielle King, Gabbie Rodriguez, Pammy Moran and Raya Buensuceso of Kaya Founders—an early-stage venture capital firm dedicated to supporting visionary entrepreneurs—represent a new wave of investors and builders setting a higher bar for inclusion, ambition, and long-term impact.

Recently recognized in the Global Private Capital Association’s inaugural Southeast Asia Women Investors Directory, these women are not just participants in the startup ecosystem—they’re actively shaping its future. We spoke with them about their career journeys, the lessons they’ve learned, the challenges they’ve overcome, and the kind of ecosystem they hope to build in the Philippines and beyond.

READ ALSO: A Shot of Disruption: An Interview With The Minds Behind PICKUP COFFEE

What first drew you to the world of tech and venture capital?

Danielle: At my previous consulting job, I worked on a B2B e-commerce platform. That experience sparked my curiosity about venture capital and how tech-driven business models could scale and thrive in emerging markets like the Philippines.

Gabbie: Fresh out of college, I landed my first job at a Singaporean VC firm, working on legal diligence. I gained an early glimpse into how structures shape outcomes, and how much resilience it takes to build lasting companies. What kept me in VC was the people. It’s truly a privilege to work closely with people who are deeply committed to solving real world problems.

Pammy: I’ve always been drawn to entrepreneurship, but it was when I was pursuing my master’s degree at USC that I discovered venture capital. I was fortunate enough to interact with seasoned investors, and that opened my eyes to the idea of championing and growing the venture ecosystem in the Philippines, where there’s immense untapped potential.

Raya: Venture capital-backed companies account for about 41% of the US stock market’s total market capitalization and nearly 60% of the S&P 500, despite VC being less than a century old. As someone committed to driving economic impact, I see tech and VC as a way to back generational companies that can transform the future of how we live, work, and play.

Tech and venture are still heavily male-dominated. What’s been your personal experience navigating that?

Danielle: While gender imbalance still exists in the wider business landscape, there’s been a noticeable increase in women investors across Southeast Asia, from analysts to partners. On the community front, we’re seeing more women-focused networks and gender-lens investors working to empower women entrepreneurs. At Kaya Founders, we have a naturally well-balanced team, thanks to the leadership’s direction.

Gabbie: While tech and venture are still male-dominated, I’ve been fortunate that my experience hasn’t made me feel marginalized. From the start, Kaya’s investment director Toby and the partners created a culture where ideas matter more than titles, and respect is given regardless of gender. I don’t take that for granted. It’s allowed me to focus fully on the work—asking the right questions, backing great founders, and pushing companies forward—without the extra weight of proving I belong.

Pammy: Throughout my career, I’ve had the pleasure of working with successful women GPs who have served as strong examples as I pave my own path. While I’m aware of the gender gap in funding for female founders and investors, it’s part of my mission to help close that gap by unlocking opportunities and making the right connections for others in the industry.

Raya: I’m deeply committed to shaping a more inclusive venture capital landscape in the Philippines. Even before joining Kaya, I started the local chapter of SoGal Foundation, which champions female founders and investors. We now have close to 100 members—the largest community of VC-backed female founders in the country. Thanks to this community, and Kaya’s inclusive workplace, I haven’t felt the imbalance as much—but I know this is the exception, not the norm, and there’s still a lot of work to be done.

Are there any industry norms or behaviors you’ve seen that you’d like to see shift in the future?

Danielle: I hope to see more businesses and individuals embrace tech solutions in their day-to-day lives. Driving this shift starts with addressing grassroots problems and creating opportunities for people to adopt new tools and innovations, leveraging the natural tech-savviness of Filipinos.

Gabbie: I believe the industry could benefit from a greater focus on investing in impact—backing companies that offer financial returns and drive positive social or environmental change. While impact investing is becoming more mainstream, I’d love to see it integrated more deeply into venture decision-making.

Pammy: I’d love to see entrepreneurship championed more as a career path for young talent. Great founders are everywhere—it’s just about giving them the chance to see it in themselves. While we’re seeing more young founders making waves, especially in the Philippines, I hope we continue to champion the idea, provide more opportunities to first-time entrepreneurs, and equip them with the resources and support they need to succeed.

Raya: I hope we can be more collaborative and open as an ecosystem, because we’re still in the early days and need all the help we can get—whether from men or women, locals or foreigners. I still see pockets of gatekeeping and crab mentality, sometimes masked as national pride, or short-term games that ultimately stifle progress. We need to move past that if we want real growth.

READ ALSO: Charles Stewart Lee Is Set To Disrupt, Hustle, Innovate

You were featured in the Global Private Capital Association’s inaugural Southeast Asia Women Investors Directory—what does that recognition mean to you?

Danielle: I’m honored to be included in the directory as a woman investor in Southeast Asia. We pour our best efforts into the work we do, and I hope it reflects our commitment to supporting founders and helping shape the region’s growing startup ecosystem.

Gabbie: I’m grateful for the recognition, though it’s not the driving force behind what I do. What matters more is the impact we make every day. That said, being featured is a humbling reminder that women are carving out a significant space in venture capital—a small milestone in a much larger journey to reshape what leadership in this field looks like.

Raya: The most notable part of the recognition was that Kaya women accounted for 40% of the female investors featured from the Philippines. It’s both validating and problematic—validating our commitment to hiring women, but also highlighting how much more work needs to be done to grow the number of female investors in the country.

What advice would you give a young Filipina who wants to break into entrepreneurship or investing?

Danielle: Go for it! Now more than ever, there’s a strong and growing community ready to support women entrepreneurs and investors. The journey can be tough, but being surrounded by people who understand what you’re going through makes all the difference. Don’t hesitate to reach out—people are often more willing to help than you expect.

Gabbie: Start by trusting in your own potential and not letting self-doubt hold you back. The space can feel intimidating, but remember that your unique background is a strength, not a limitation. Building a network is crucial, so surround yourself with people who inspire you and believe in your abilities.

Pammy: It can feel daunting, but go to events, meet people, and network. Talk to as many people as possible—just a few conversations can open doors you never imagined. Little by little, you build confidence, trust your abilities, and discover what makes you unique. Most of my opportunities in startups and investing came from simply putting myself out there. The right ones will find you at the right time, just like how I met the Kaya Founders team.

Raya: Find a way to get your foot in the door and build from there. For me, that entry point was starting SoGal Manila in 2019, which eventually led to reconnecting with Paulo Campos and joining Kaya. If you’re an aspiring entrepreneur, consider working for a tech startup first to learn the ropes. Network aggressively and leverage platforms like LinkedIn—you might be surprised how many people are willing to grab a quick coffee and share advice

Photography by Ed Simon of KLIQ, Inc.